Paying off an automobile loan earlier than regular not simply shortens the size from the loan but may also lead to curiosity personal savings. Even so, some lenders have an early payoff penalty or terms limiting early payoff. It is crucial to examine the details diligently prior to signing an vehicle loan agreement.

Federal Housing Administration (FHA) loans: This type of loan is on the market into a borrower who wishes to order a property but contains a credit rating ranking under 580.

Ability—steps a borrower's capacity to repay a loan using a ratio to match their debt to revenue

Browsing for personal loan phrases and rates can assist you discover the most effective loan selection for your preferences. Lantern makes the method straightforward and handy. By filling out one particular application, you may Assess provides from several lenders directly.

Credit history, and also to a lesser extent, earnings, typically decides acceptance for automobile loans, whether by dealership financing or immediate lending. Additionally, borrowers with outstanding credit history will most probably acquire decrease curiosity fees, which can cause paying out much less to get a car Total.

There isn’t automatically a particular form of loan the Rule of 78 is useful for. Nevertheless, For those who have negative credit, you may want to preserve an eye fixed out for that Rule of 78 any time you’re taking out a loan. The Rule of seventy eight has long been used for subprime individual loans and subprime car loans, By way of example.

process. But as a consequence of some mathematical quirks, you end up paying out a bigger share with the desire upfront. Which means when you pay off the loan early, you’ll finish up having to pay more Over-all for just a Rule of seventy eight loan as opposed with a simple-interest loan.

When you have certain questions on the accessibility of This web site, or require assistance with utilizing this site, contact us.

The good news is always that much more lenders use a straightforward-interest system as opposed to Rule of 78, and many states have outlawed this unbalanced fascination components altogether. Furthermore, the primary difference in fascination charges could only be a few dollars, based on your loan volume and curiosity level.

At the time a loan arrangement has been finalized along with the borrower has been given the funds requested, they must Stick to the repayment plan specified from the agreement.

Financial debt consolidation and credit card refinancing contain employing a new loan to pay off your existing balance. This does not eliminate financial debt, but replaces just one personal debt with An additional. Though individual loan costs frequently are reduce than charge card curiosity charges, you might shell out much more in origination costs and desire over the life of the loan according to other loan conditions. Be sure to talk to a financial advisor to determine if refinancing or consolidating is ideal for you.

And you almost certainly think repaying a loan early click here will decrease the level of curiosity you pay out on The cash you’ve borrowed. But In the event your lender takes advantage of the Rule of 78 approach — often called the “Sum of your Digits” strategy — to work out exactly how much fascination to refund to you personally after you pay back a loan early, you continue to could finish up paying a lot more desire than you expected.

This kind of loan is rarely produced besides in the form of bonds. Technically, bonds run in different ways from far more traditional loans in that borrowers produce a predetermined payment at maturity.

LendingTree is compensated by providers on This page and this compensation may well effect how and where by delivers show up on This web site (including the buy). LendingTree isn't going to consist of all lenders, price savings solutions, or loan alternatives obtainable in the Market.

Jeremy Miller Then & Now!

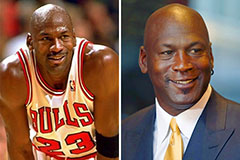

Jeremy Miller Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Susan Dey Then & Now!

Susan Dey Then & Now!